Invest in the S&P500 for 40 years, what could go wrong?

Countless YouTube videos, TikTok reels and LinkedIn posts saying that this is a guaranteed path to financial freedom.

Terms like "compounding" are thrown around along with charts and numbers to make it look scientific.

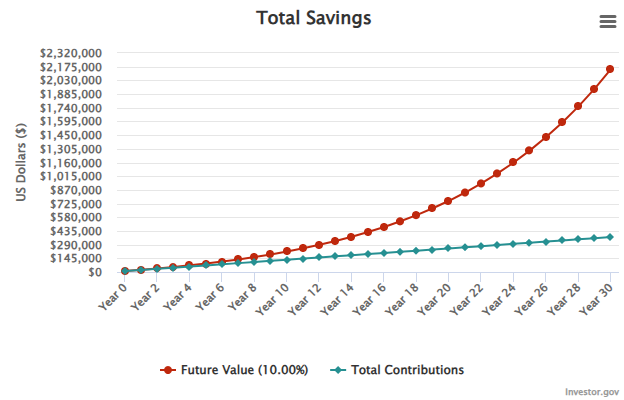

Start with $10,000 in savings, contribute $500 a month, and invest it in a low-cost ETF tracking the S&P500.

Then, even if you only get a 7% annual return on average (below the historical average of the S&P500, but close to what you'd get after inflation) you will become a millionaire in around 40 years.

And you'd have only paid in around $250,000 over this period. Like the chart below.

I have 3 fundamental issues with this narrative.

FIRST

This narrative makes 4 implicit assumptions that aren't talked about enough.

- You have $10,000 to start with.

- You can contribute $500 a month, every month, for 40 years.

Together, these two assumptions imply you have a steady monthly income that exceeds your needs by at least $500, throughout your working life.

Yet no one talks about HOW to get that steady income.

It is THIS ability to get a steady income that is the real wealth-creation machine people should be obsessed about.

It comes from creating real value, either a job or business. Not from investing.

Then there are the other two assumptions:

- You want to invest in the S&P500.

- The S&P500 will continue to grow as it has done in the past.

The S&P500 is not for everyone. Some people want to invest in their own country, to support causes they care about, that benefit their own community.

And there's no guarantee that all the technological growth over the next 40 years will come from the US, as it has done in the past 100 years.

SECOND

This narrative falsely claims you will not have to work anymore.

But neither can investing make you rich, nor can most people live off their investments.

Consider that, if you get to $1M after 40 years of work, and park it in safe investments with 4% annual return (because you can't take risks at that age), you will earn $40,000 a year.

Will this be enough for you and your entire family to live the dream retirement life that you envision when you're 60-65 years old?

Will it really mean that you will be financially independent, never having to worry about money again?

THIRD

This narrative makes it seem as if our retirement is more important than our entire working life.

As if saving $500 every month - even if it means we are stuck in a job we don't like, or if it deprives us and our families from the money we need to enjoy the journey - is justified by the end goal of having $1m after 40 years.

The value we create, and impact we leave behind, during those 40 years, is far more important.

Investing is essential. Everyone must invest. But we should invest in a narrative that we can be proud of, not a narrative being forced upon us.